Bitcoin (BTC/USD) candlestick chart, Coinbase market. Source: TradingView

{

“lineWidth”: 2,

“lineType”: 0,

“chartType”: “candlesticks”,

“fontColor”: “rgb(106, 109, 120)”,

“gridLineColor”: “rgba(242, 242, 242, 0.06)”,

“volumeUpColor”: “rgba(34, 171, 148, 0.5)”,

“volumeDownColor”: “rgba(247, 82, 95, 0.5)”,

“backgroundColor”: “#0F0F0F”,

“widgetFontColor”: “#DBDBDB”,

“upColor”: “#22ab94”,

“downColor”: “#f7525f”,

“borderUpColor”: “#22ab94”,

“borderDownColor”: “#f7525f”,

“wickUpColor”: “#22ab94”,

“wickDownColor”: “#f7525f”,

“colorTheme”: “dark”,

“isTransparent”: false,

“locale”: “en”,

“chartOnly”: false,

“scalePosition”: “right”,

“scaleMode”: “Normal”,

“fontFamily”: “-apple-system, BlinkMacSystemFont, Trebuchet MS, Roboto, Ubuntu, sans-serif”,

“valuesTracking”: “1”,

“changeMode”: “price-and-percent”,

“symbols”: [

[

“COINBASE:BTCUSD|1D”

]

],

“dateRanges”: [

“1d|1”,

“1m|30”,

“3m|60”,

“12m|1D”,

“60m|1W”,

“all|1M”

],

“fontSize”: “10”,

“headerFontSize”: “medium”,

“autosize”: false,

“width”: 640,

“height”: 400,

“noTimeScale”: false,

“hideDateRanges”: false,

“hideMarketStatus”: false,

“hideSymbolLogo”: false

}

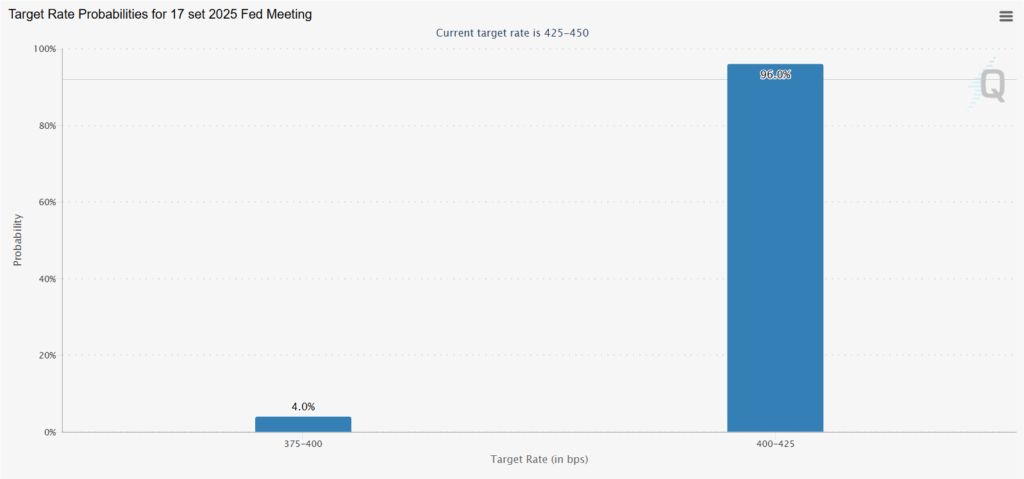

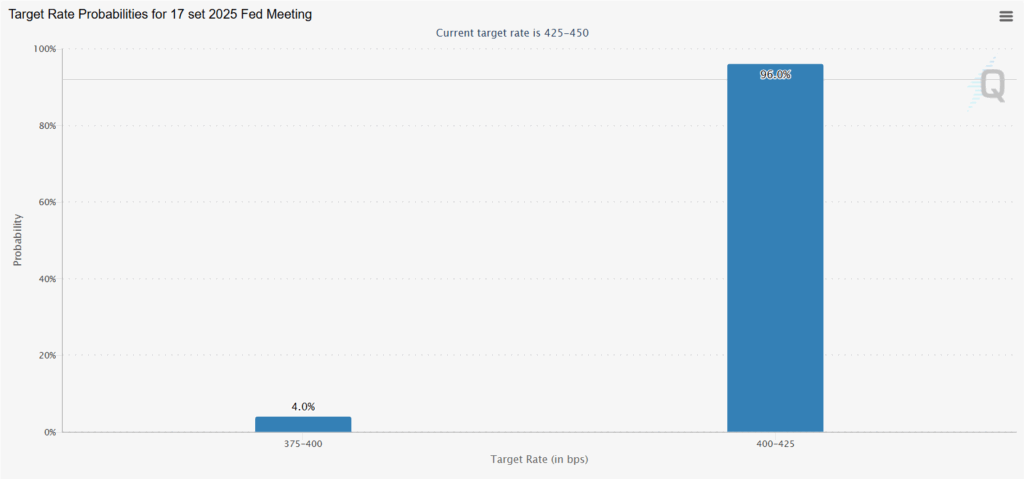

Impact of Fed Cuts on BTC Trajectory

A 25 bps cut, in line with consensus, tends to favor risky assets due to more accommodative financial conditions. If the area $118,000 consolidates as support, the dynamic could accelerate towards new highs. However, the reaction will heavily depend on the language of Jerome Powell: a “data-dependent” message with caution on inflation could limit enthusiasm, while a signal of a multi-cut path would strengthen sentiment.

Technical levels to monitor: resistances, supports, and scenarios

The range $117,500–$118,500 remains the short-term resistance. Beyond this zone, traders map out the following steps:

- Decisive breakthrough of $118,000 — intermediate target at $120,000.

- Price discovery — extension towards $124,500 in case of sustained momentum.

- Rejection at resistance — supports at $116,800–$114,500; possible retest of $112,000 (level corresponding to the 100-day SMA).

In this context, risk management remains central: tight ranges and rapid reactions to key levels can amplify intraday movements. For operational strategies and risk management tips, please refer to our guide on risk management.

September FOMC: What to Listen for in Powell’s Speech

Traders look at three elements: size of the cut, dot plot (rate projections), and the guidance for upcoming meetings. Indeed, an implicit indication of more cuts by the end of the year would strengthen the liquidity theme, often favorable to BTC. According to Swissblock, it is reasonable to expect greater volatility around the announcement, and their Bitcoin Risk Index can help assess the strength of the bullish structure.

Context Data: Volumes, Derivatives, and On‑Chain

- Spot volumes — up by ~18% compared to the 30-day average, indicating increasing participation on the eve of the meeting.

- Open interest on derivatives — increased by approximately 6% in the last 48 hours, with a higher positioning in near-term expirations.

- Funding rate — slightly positive, around +0.01% daily, indicative of a prevalence of long positions in the short term.

- On‑chain — network activity shows net flows from exchanges consistent with a cautious accumulation phase (net outflow estimated at around 7,500 BTC in the last 30 days).

These elements, combined with the macro calendar, explain the increase in price elasticity near the FOMC event.

Voices from the Market: What Analysts Are Saying

The analyst Michaël van de Poppe indicates that a clean break of $118K could pave the way to $120K and beyond.

While the user Jelle identifies the $116.5K–$118K zone as the directional area for the session.

Quick FAQ

Reliability of the probabilities of a 25 bps cut in September

The readings of CME FedWatch and prediction markets like Polymarket represent the implicit consensus of operators in real-time. Although useful for nowcasting event risk, such probabilities remain non-binding: surprises in Powell’s conference could overturn the pricing in a matter of minutes.

Conclusion

With $117,000 reached and the $118,000 threshold in sight, the BTC market is in a particularly sensitive phase. A rate cut in line with expectations and accommodative guidance could push the price towards $120,000 and even $124,500, while more hawkish communication could lead to a return towards the support area between $116,800 and $114,500. It should be noted that the initial reaction could be followed by a rebalancing in the hours following the Fed conference.

Disclaimer: the information is for journalistic purposes and does not constitute financial advice. Trading in the markets involves risks.